- The notice of assessment explained : Start this lesson

- What’s on your notice of assessment

- Notice details

- Account summary : Start this lesson

- Tax assessment and summary

- Explanation of changes : Start this lesson

- Additional information

- How to get a copy of your notice of assessment

- 1 question to test yourself

- 1 video (3:22)

Resources : Reading your notice of assessment

- Understand your notice of assessment open in new window

- Registered retirement savings plan (RRSP) open in new window

- Contact the Canada Revenue Agency open in new window

- Get a proof of income statement open in new window

- Home Buyer’s Plan (HBP) open in new window

- Lifelong Learning Plan (LLP) open in new window

- Express NOA open in new window

Reading your notice of assessment (part 1 of 8)

The notice of assessment explained

A notice of assessment is a tax document the Canada Revenue Agency (CRA) sends you after processing and assessing your income tax and benefit return. You’ll receive a notice for every tax return you file.

Income tax and benefit return Income tax and benefit return

Your notice is your summary for a tax year, based on the income, deductions, and credits you report on your tax return. Also, your notice may contain information you will need when you do your taxes for the next tax year.

Tax year Tax year Report Report

Your notice of assessment is an important document that contains your personal information. Keep it in a safe place with your tax records.

You should not share your personal information unless it is necessary. For example, the information from your notice may be used to identify you when you call the CRA. You may also be asked to provide a copy of your notice to a financial institution or a community organization to prove that you did your taxes or what your income was in the previous year.

If you or the CRA changes your tax return after the first assessment, you will receive a notice of reassessment. A notice of reassessment looks like a notice of assessment. But a notice of reassessment will have information about changes to your return.

Resources are available

After you finish this lesson, this resource link will be available:

- Understand your notice of assessment

Test yourself

The information from your notice is used to identify you when you call the CRA. You may also be asked to provide a copy to a financial institution or a community organization to prove that you did your taxes or what your income was in the previous year.

Sorry, that's incorrect.

The information from your notice is used to identify you when you call the CRA. You may also be asked to provide a copy to a financial institution or a community organization to prove that you did your taxes or what your income was in the previous year.

The one about your pay stub

TranscriptReading your notice of assessment (part 2 of 8)

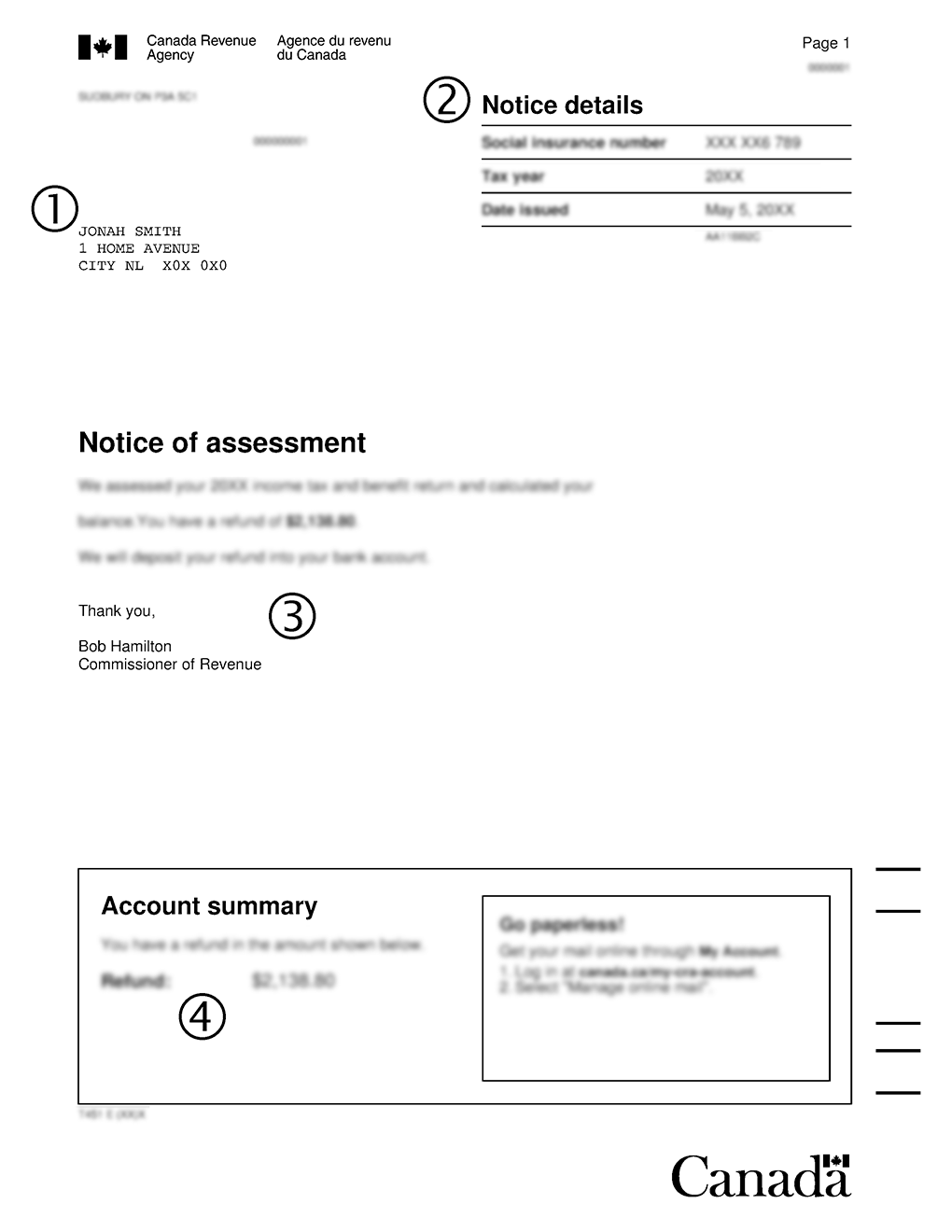

What’s on your notice of assessment

Toggle between each page of the notice of assessment to get an overview of what is on each page. You will find more details about each section later in this lesson.

The first page of your notice of assessment provides you with the following information:

- Your name and address

- Your notice details

- A message from the commissioner

- An account summary showing the final result of your tax return

Note: Electronic and paper versions of your notice may look a bit different, but they contain the same information.

Details of this page exist further in the lesson.

The second page of your notice of assessment provides you with the following information:

- A summary of your tax return

- An explanation of changes and other important information

Note: Electronic and paper versions of your notice may look a bit different, but they contain the same information.

Details of this page exist further in the lesson.

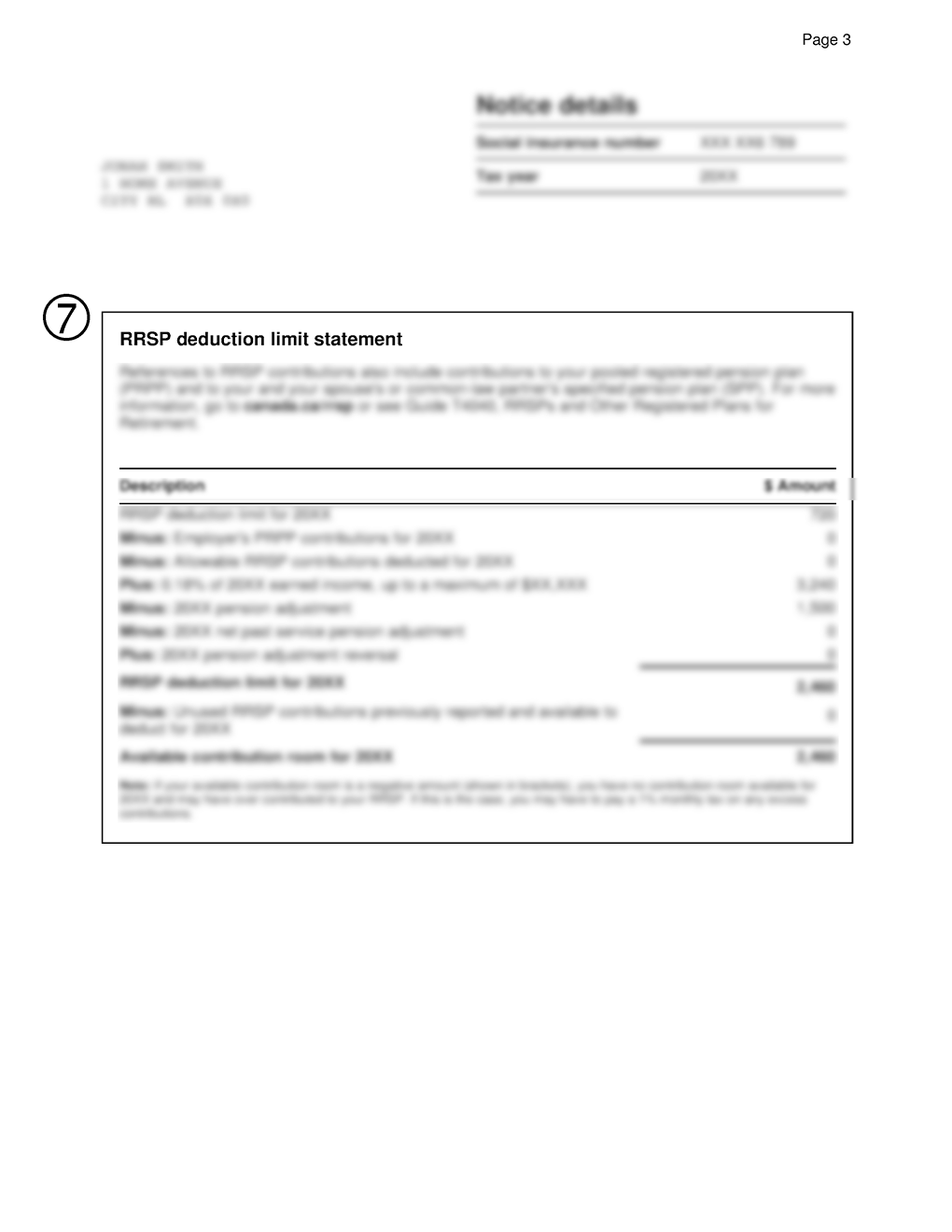

The third page of your notice of assessment provides you with the following information:

- Your registered retirement savings plan (RRSP) deduction limit statement Registered retirement savings plan (RRSP) Registered retirement savings plan (RRSP)

Note: Electronic and paper versions of your notice may look a bit different, but they contain the same information.

Details of this page exist further in the lesson.

The fourth page of your notice of assessment provides you with the following information:

- More general information

Note: Electronic and paper versions of your notice may look a bit different, but they contain the same information.

Details of this page exist further in the lesson.

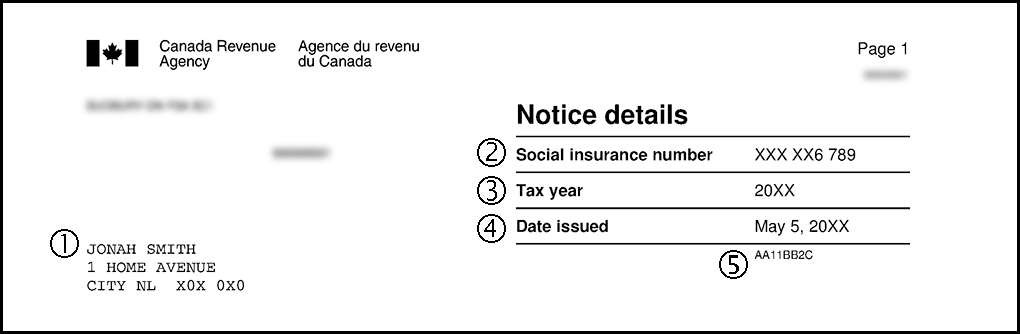

Reading your notice of assessment (part 3 of 8)

Notice details

Your notice of assessment shows the following information:

1. Your name and address

- Jonah Smith

1 Home Avenue

City NL X0X 0X0

- XXX XX6 789

- 20XX

- May 5, 20XX

- AA11BB2C

Reading your notice of assessment (part 4 of 8)

Account summary

This section of the notice of assessment shows you the result of your tax return.

Depending on your income and credits, the result may be any of the following:

- a refund, when the CRA owes you an amount (shown as CR, for credit)

- a balance owing, when you owe an amount to the CRA (shown as DR, for debit)

- a zero balance, when neither you nor the CRA owes an amount

You may be late doing your taxes for several years and file more than one tax return at once (for example, you file your 2018, 2019 and 2020 returns together). In this case, the CRA will assess all your returns at the same time. You will receive one notice of assessment for each year. Check the notice for the most recent year for the final result.

If you had a balance owing when you did your taxes but have since paid the amount, your notice will show the balance when your return was assessed. If you need proof that you paid the amount, you can print a statement from My Account or contact the CRA to ask for printed confirmation.

My Account My AccountReading your notice of assessment (part 5 of 8)

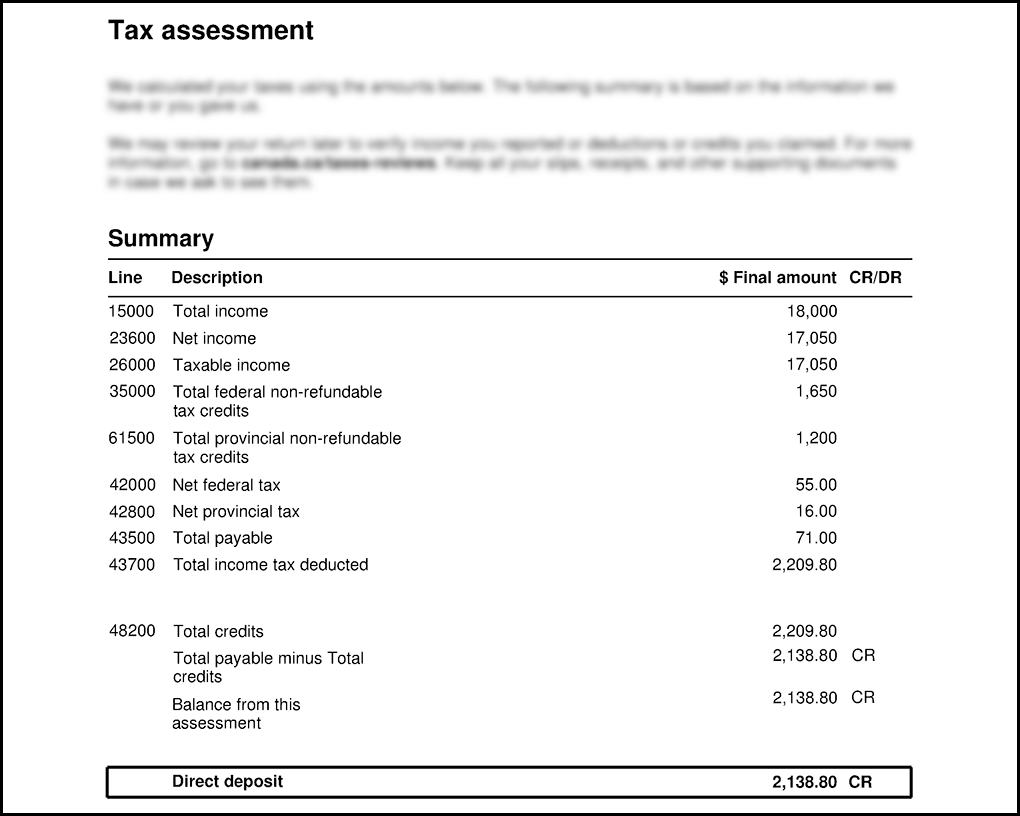

Tax assessment and summary

Line 15000 Total income: 18,000

Line 23600 Net income: 17,050

Line 26000 Taxable income: 17,050

Line 35000 Total federal non-refundable tax credits: 1,650

Line 61500 Total provincial non-refundable tax credits: 1,200

Line 42000 Net federal tax: 55.00

Line 42800 Net provincial tax: 16.00

Line 43500 Total payable: 71.00

Line 43700 Total income tax deducted: 2,209.80

Line 48200 Total credits: 2,209.80

Total payable minus Total credits: 2,138.80 CR

Balance from this assessment: 2,138.80 CR

Direct deposit: 2,138.80 CR

This section of the notice of assessment shows the main lines of your tax return. The CRA used the amounts you see to calculate your final result, which could be a refund, a balance owing, or a zero balance.

The amounts you’ll see in this section include:

- Total income

- Net income

- Taxable income

- Total non-refundable tax credits

- Net federal and provincial or territorial tax

- Total payable

- Total credits

- Balance from this assessment (refund, balance owing, or zero balance)

The amounts might not match what you reported on your return if the CRA has made changes.

You will also see any penalty and interest the CRA may have charged. If you have a balance owing on your account from another tax return, which you have not paid yet, that balance will show here.

Test yourself

Sorry, that's incorrect.

The summary lists the main lines of your tax return. The amounts might not match what you reported on your return if the CRA has made changes.

The summary lists the main lines of your tax return. The amounts might not match what you reported on your return if the CRA has made changes.

Reading your notice of assessment (part 6 of 8)

Explanation of changes

This section of the notice of assessment explains in detail any changes or corrections the CRA made to your tax return.

Sometimes the CRA will make a change based on the information you sent with your return. Other times, the change is based on information the CRA has on file. For example, the CRA will automatically include any unused tuition amounts you have on file if you forgot to include them when you did your taxes.

Read this section carefully to understand the final result of your assessment and to learn if you need to do anything to correct your return.

If you have any carryforward amounts available, like unused tuition amounts, your notice will show those amounts here. This information will be helpful when you do your taxes for the next tax year, since those amounts can reduce the tax you may have to pay in a future year.

Carryforward amounts Carryforward amounts

Example: Reading the explanation of changes

Melinda did her taxes and her refund was deposited into her bank account. She noticed that the amount was less than she had calculated.

Before calling the CRA, she checked her notice of assessment by signing into My Account. She read the explanation of changes, which explained that she did not respond to a letter asking for supporting documents for the medical expenses she had claimed.

Melinda had received that letter but forgot to respond. She corrected her tax return by sending in her receipts to the CRA. Once the CRA completed its review, it adjusted her return and issued the remainder of her refund.

Reading your notice of assessment (part 7 of 8)

Additional information

Your notice of assessment includes other information on the last few pages that generally depends on your situation.

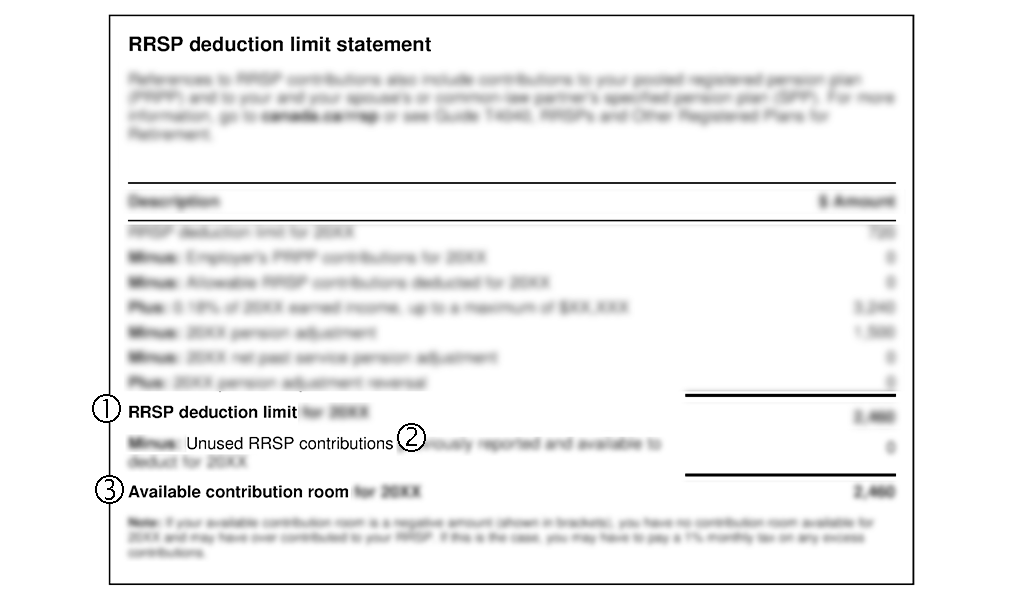

RRSP deduction limit statement

This section shows how much you can contribute or deduct in the following year.

Some of the key amounts you’ll see in this section include:

- your RRSP deduction limit

This is the amount of RRSP contributions you can deduct for the next tax year. Your notice will show how the CRA calculated this amount. - your unused RRSP contributions

If you reported RRSP contributions in previous years but did not claim a deduction for them, they will show here. You can still deduct them in future years, as long as the amounts are within your deduction limit. - your available contribution room

This is the maximum amount you can contribute for the next tax year and takes your unused contributions into consideration. If your RRSP contributions are more than this amount, you have an excess of contributions, and you may have to pay tax on the excess amount.

Resources are available

After you finish this lesson, this resource link will be available:

- Registered retirement savings plan (RRSP)

You may have used the money in your RRSP to buy a home through the HBP or to finance full-time training or education through the LLP. Both of these programs require you to repay the money to your RRSP over a set period of time.

Your notice may show your remaining balance to repay and your minimum required repayment for the next year.

Resources are available

After you finish this lesson, these resource links will be available:

- Home Buyer’s Plan (HBP)

- Lifelong Learning Plan (LLP)

Your notice will include CRA information and resources to help after you have done your taxes, like what to do if:

- you move

- you want to change your return

- you want to register a formal dispute (objection)

You will also see definitions and links to web pages that will give you more information about:

- help for persons with hearing, speech, or visual impairments

- My Account

- fraudulent communications (scams)

Reading your notice of assessment (part 8 of 8)

How to get a copy of your notice of assessment

The CRA sends you your notice of assessment (NOA) after it assesses your return.

If your correspondence preferences are set to “Electronic mail,” you will get an email letting you know that you have mail in My Account when it’s available. The only way to read your online mail, like your notice of assessment, is by using My Account. You will not receive a paper copy of most CRA mail.

If “Electronic mail” is not ticked in your correspondence preferences, you will receive a paper copy of your notice of assessment. Your notice will still be available to view in My Account, but you will not receive an email notification about it.

Get an express copy of your notice

If you are registered for My Account and use NETFILE-certified tax software to do your taxes electronically, you can use the Express NOA service.

The Express NOA will be delivered into your software right after filing your return.

Resources are available

After you finish this lesson, this resource link will be available:

If you need another copy of your notice, you can access it online in My Account or request a copy by contacting the CRA.

You can also request your notice in a different format, such as:

Proof of income statement

Organizations like your financial institution might ask you to provide a proof of income statement or an option C print. The print is a version of your return.

A proof of income statement has much of the same information as your notice of assessment and looks very similar to it. The statement shows the income, deductions and tax credits the CRA used to assess your tax return. However, the statement does not include an explanation of changes or additional information.

You can get a proof of income statement online from My Account or by contacting the CRA.

Resources are available

After you finish this lesson, these resource links will be available:

- Contacting the CRA

- Get a proof of income statement